As we look to what is driving change in the financial industry, technology focused innovation is clearly a driving force shaping the way many consumers will utilize financial services. Traditional banks and credit unions are quickly taking notice of new financial technology players entering the financial services business.

Fintech’s seek to gain a foothold to deliver financial services to the younger tech savvy generation. In-order for traditional financial institutions to maintain and attract new customers, they desire to measure, and improve the customer experience at retail locations. In my discussions with financial institutions, their goal is to utilize the investment they have made in innovative video surveillance technology. As the number of cameras being used to monitor both public and private property grows world-wide, there is an increased demand for the use of artificial intelligence (or “AI”) to leverage the metadata in video streams that can be utilized when using intelligent IP video products. Whether it is gathering data for a business to improve its operations or receiving alerts due to a security or safety issue, cameras are proving to be more than tools to be a reactive investigation tool.

Because of the taxing nature of artificial intelligence on hardware, a server has traditionally been required to integrate into a VMS to run the software and provide the processing power required for AI to work properly. This traditional server requirement makes many desired projects cost-prohibitive or complex.

To address this, Axis Communications released its first camera with a Deep Learning Processing Unit (“DLPU”) in January 2021. This allowed Axis cameras with a powerful DLPU chip to host third-party AI analytics right on the camera via the AXIS Camera Application Platform (“ACAP”) with no server required. While running analytics on a server on location has historically provided performance advantages, powerful on-board processing now opens the door for new solution benefits on the edge. Edge analytics are video analytics that process and analyze video data right on the camera - close to where it’s captured - rather than on a server or in the cloud. On-board deep learning capabilities offer a unique opportunity for solution providers to develop third-party applications based on AI that can solve specific problems.

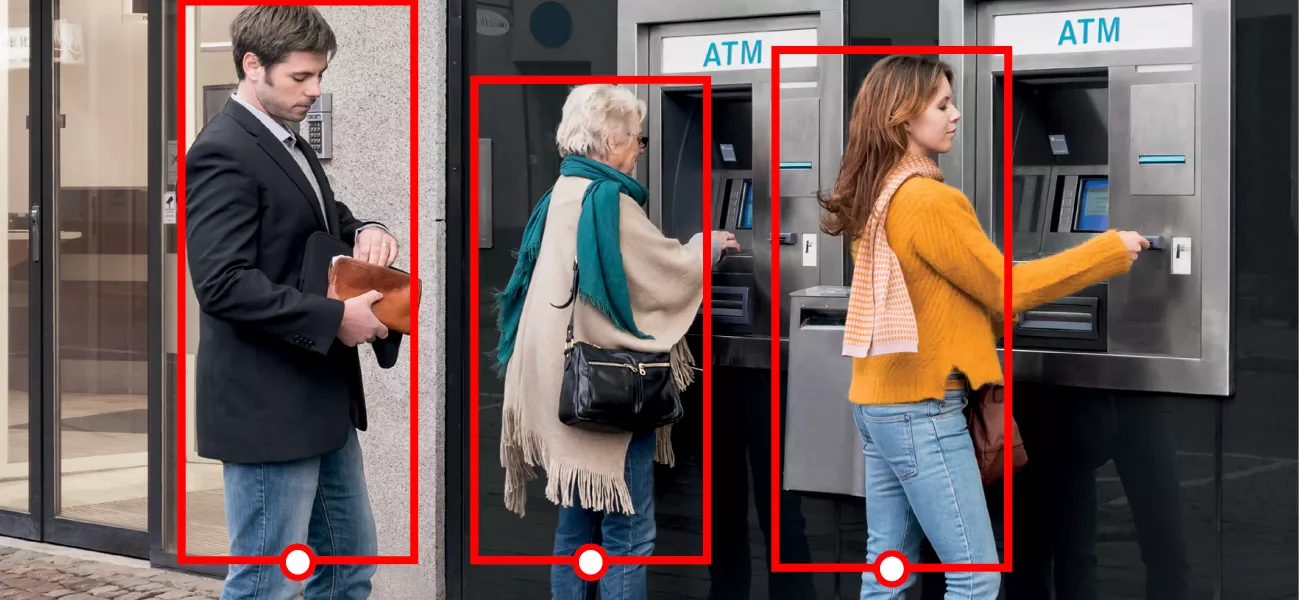

In the financial sector, retail institutions are focused on providing the best customer experience possible. In certain areas of the country, a problem that has arisen is people loitering in ATM vestibules. Loitering poses a series of problems for risk, liability, security, safety, and the customer experience while attempting to use an ATM. An advanced analytic was developed by an Axis technology solution partner leveraging the new DLPU chip to solve this problem for one retail financial institution.

Case Study: Not all AI is Created Equal

A major US retail financial institution reached out to Axis with a problem: people loitering, or even sleeping in ATM vestibules. The costs of patrolling and removing people, cleaning, and repairing the vestibules, and the safety concerns for the retail banking and credit union clients made it necessary for the issue to be addressed immediately. To be cost-effective over many locations, a server-based solution was not an option.

Before AI, companies used image processing software (marketed as AI) to trigger an alert if many pixels in close proximity changed contrast, the assumption being if large numbers of pixels changed in the same area there was probably a person present. This had two problems: first, there are many things that can cause pixels to change, so false alarms were an issue. Second, if a person stops moving, no pixels change, so the person was no longer detected. The retail financial institution in question tried this technology first, but the lengthy setup time, and number of both misses and false positives made it unusable to the client.

Axis reached out to AiDANT Intelligent Technology, an Axis Technology Partner that specializes in Computer Vision AI, and the first company in the world to put AI software entirely on an Axis camera as an ACAP with no server. The financial institution installed AiDANT Aware, an AiDANT ACAP, on its Axis DLPU cameras to run a pilot. AiDANT Aware runs entirely on the camera with no additional server and uses true machine-learning to identify people and time how long they have been there. It tracks people and sends an alert if someone is in the location for longer than a specified time and does not require that the people be moving to be detected. It even detected people who were laying down motionless and partially covered with blankets. Unlike the previous technology the financial client had used, AiDANT Aware was installed and configured in a few minutes.

At the end of the pilot, it was determined to be a success with an accuracy of >95% with very few false positives. AiDANT Aware is now being piloted by numerous banks in various countries around the world.

This illustrates that a large server-based solution is not the only option when a client wants AI or other high-performing analytics as part of their security solution. With more Axis cameras being fitted with DLPU chips, analytics being installed right on the camera without a server is gaining popularity due to their simplicity, flexibility, scalability, and reduced costs.

AiDANT Intelligent Technologies website: www.aidant.ai or email info@aidant.ai