Towards the end of 2023, the International Data Corporation (IDC) released its IDC MarketScape: Worldwide Video Surveillance Camera 2023 Vendor Assessment (doc #S51309223, October 2023). Leveraging various research methods, the report outlines the demands faced by those in the market and provides advice for technology buyers looking to weigh the pros and cons of different vendors.

This week, we had the opportunity to sit down with IDC analyst Mike Jude, who provided us with a valuable glimpse into how IDC views the video surveillance market and how he sees it evolving over the coming years.

Q. What is your view of where the video surveillance market stands today in general? How would you describe the market?

Jude: “I would say that the video surveillance market is at a pivotal point right now, which makes this an exciting time. Across a broad range of industries, there is this growing realization that video data can serve as a primary telemetric source for more pervasive physical security platforms. And when it is combined with other sensors, video surveillance can not only improve physical security and situational awareness, but actually service business intelligence objectives like facility utilization and process improvement. In fact, IDC has survey data that shows physical security professionals are already beginning to think in terms of business impact when reviewing video surveillance data, rather than focusing exclusively on security.”

Q. What drives customers’ demands for cameras today? How is this likely to change?

Jude: “Security has traditionally been the primary use case for surveillance cameras, and that remains true. Most businesses with a significant deployment of cameras and other surveillance sensors are using them for safety and security purposes. That said, a growing number of businesses are finding that they can leverage these same devices for business applications as well. It isn’t the main driver for these devices—at least not yet—but more and more organizations are integrating video telemetry with information from across multiple business groups and using that information to generate actionable insights. This trend will only grow more pronounced as we move into the future.”

Q. What was the scope of this report? (IDC MarketScape: Worldwide Video Surveillance Camera 2023 Vendor Assessment)

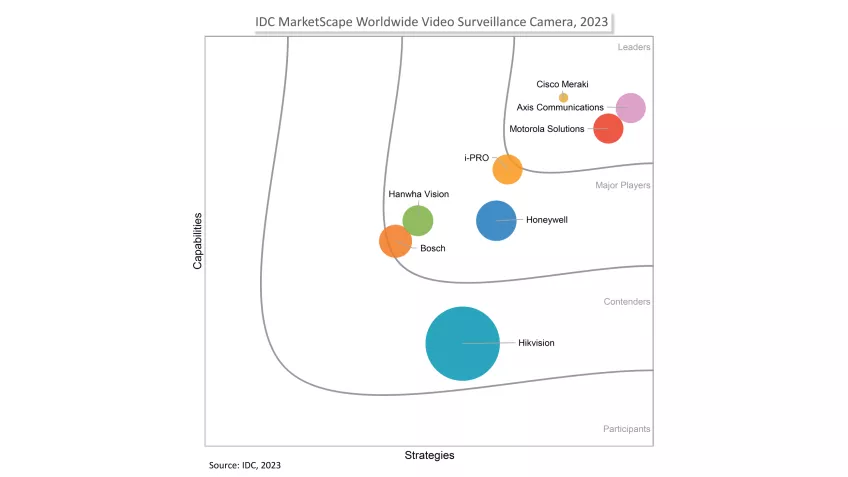

Jude: “The focus of the IDC MarketScape report is the commercial use of video cameras, and it was driven by the needs and requirements expressed by users. The aim was to assess both the drivers and the roadblocks impacting the video surveillance camera market, and then to compare these factors to representative camera vendors to see how they address those drivers and roadblocks. In particular, the report focuses on the technical capabilities, breadth of camera offerings, and overall ability to support the specific needs of today’s in-demand analytic engines. The report doesn’t focus on the actual analytic capabilities, but it does include findings on whether or not device manufacturers can interface with analytics applications. It is important to note that an IDC MarketScape is not a “beauty contest” where relative positions in the IDC MarketScape graph compare one vendor to another. In fact, positions on the graph denote the relative positions of the vendors against market needs as disclosed by IDC user surveys.”

Q. The report evaluates companies on two axes—capabilities and strategies. How do you define these categories and what are some of the most important elements of each?

Jude: “You can think of “capabilities” as what a vendor can deliver today. The capabilities axis measures a manufacturer’s current value proposition to customers. “Strategies,” on the other hand, are the capabilities likely to be delivered to the market in the future. Essentially, the way a vendor maps to the graph indicates to what extent IDC believes it can meet a customer’s current needs, but also how effectively it is anticipating the future needs of those same customers. In this way, the graph isn’t intended as a point-in-time snapshot, but a prediction of how well vendors have planned for the future needs of the industry.”

Q. What’s significant about the companies in the Leaders category?

Jude: “Companies in the upper right-hand category are generally ones that address the current needs of their customers. It’s important to note that vendors can do very well simply by only addressing current needs—so it would be a mistake to consider this graph a beauty contest. Not every organization wants to be on the “bleeding edge” of technological innovation. Some would prefer to deploy solid video surveillance capabilities that will stand the test of time, rather than high-tech solutions likely to require considerable updates and modifications over time. That said, the vendors that fall into the upper right “leaders” category tend to be businesses that effectively balance meeting current needs with anticipating future ones. They have demonstrated a high degree of strategic thought when it comes to developing products and capabilities designed to meet new and emerging needs, rather than simply addressing the needs of the moment.”

Q. Do you see any similarities and/or differences between the video surveillance industry compared to other industries? And any trends?

Jude: “Definitely. The video surveillance market is very closely aligned with the broader Internet of Things (IoT) market—especially as cameras grow more intelligent, with increased processing and storage at the network edge. Additionally, physical security information management (PSIM) and business intelligence applications are both markets that have a high degree of synergy with video surveillance. Both are expected to grow significantly in the future, which likely bodes well for the video surveillance market as well. The PSIM market is particularly interesting, as PSIM vendors really only began connecting to video analytics in 2023—but now the information from video is being used to provide increased situational awareness and is serving as a substantial data source for PSIM platforms.

The physical security ecosystem has evolved considerably in just the past few years as organizations look to get the most out of their video solutions. Today’s businesses are increasingly seeking to integrate video data with other telemetric sources to service both security and business-driven needs, and since 2023, efforts to merge that data under the broader umbrella of physical security have intensified. This will be something to keep an eye on moving forward.”

Q. What’s your main/key advice for technology buyers of surveillance cameras? And why?

Jude: “Before purchasing cameras, organizations need to clearly understand the applications and capabilities they currently need—but they also need to consider how they may wish to use video data in the future. Video cameras have a longer expected lifespan than other devices—organizations purchasing cameras usually expect them to last for at least a decade before replacing them, which means those devices need to be able to address an evolving set of requirements over an extended period of time. No business wants to find itself locked into a product line that no longer serves their needs—or realize just three years after purchasing a set of cameras that they need to be replaced with a newer, more advanced model. This isn’t a market that should be entered impulsively. It’s critical to take the time to understand the needs of the business and identify the vendors and devices capable of meeting those needs in both the present and the future.”

About Mike Jude

Mike Jude is the Research Director for the IDC Endpoint Security practice within the Security & Trust Group, and former Research Director for Video Surveillance and Computer Vision Technology. Dr. Jude’s core research coverage includes solutions that defend personal computing devices, physical servers, and mobile devices against a widening array of cyberattacks. Functions covered include end-user device prevention and protection, server security, detection and response, mobile threat management, and the expanding array of capabilities in consumer digital life protection. Drawing on his background in telecommunications regulation and data network infrastructure design, Dr. Jude’s research also focuses on the regulatory and public policy implications of cybersecurity at the endpoint.